Credit rating tells about the ability to raise funds from internal or external sources and its sustainability.

PF and VPF (Voluntary Provident Fund): Why should you opt for VPF and Benefits & Interest Rate 2023

Investors should consider the credit rating of the issuer before investing in NCDs. Companies are ranked by credit rating agencies such as CRISIL, CARE, etc. A higher credit rating means that the company has the ability to fulfil credit obligations. However, a low credit rating means that the company has high credit risks involved. If any issuing company fails to make payments, then the rating agencies give them a lesser ranking. Investment in securities market are subject to market risks, read all the related documents carefully before investing.

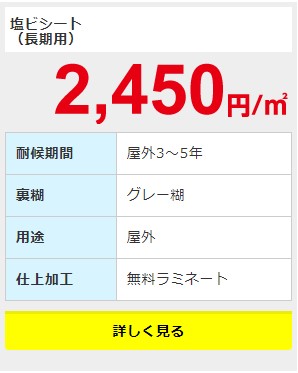

Return Rates

Issued through public offerings by high-rated companies, NCDs are distinct in their inability to convert into equity or stocks. Just the interest rates alone do not decide the actual return an investor may get from the investment into non-convertible debentures. Running a check on the company’s health is also important; to check if the company will be able to honour the NCD payments to investors on maturity. Non-convertible debentures are not backed by any collateral, thus, only companies with good credit ratings can issue debentures. Even the NCD debentures are regularly rated by credit rating agencies.

Non-convertible debentures (NCDs) are financial instruments used by companies to raise long-term funds through public issues. Unlike convertible debentures, NCDs cannot be converted into shares or equities. Companies are ranked by credit rating agencies such as CRISIL, CARE etc.

Can I sell an NCD before maturity?

Our Super App is apowerhouse of cutting-edge tools such as basket orders, GTT orders,SmartAPI, advanced charts and others that help you navigate capitalmarkets like a pro. However, they are listed on the stock market, allowing investors to sell them in the secondary market if needed. CAR is a measure of a bank’s capital in relation to its risk-weighted assets. It is an important indicator of a bank’s financial strength and stability. A higher CAR indicates that the bank has a strong capital base and is better equipped to absorb losses. Therefore, it is important to check the CAR of the issuing bank before investing in its NCDs.

Some scrutiny of the financial statements of the issuer is also required before investing in any non-convertible debentures. The assets quality of the company, debt-equity ratio, etc., should be considered. If you’re interested in investing in bonds, NCDs may be worth a look.

Equity and debentures are the most common forms of raising funds for any company. Equity shares of the company provide the investors with ownership of the company. While debentures do not always provide this benefit, there are several other features of debentures that make them an attractive investment. Debentures are typically issued by large companies to raise funds.

Secured NCDs are those NCDs that are backed by the issuer company’s assets. The NCDs will be subject to LTCG at a rate of 20% with indexation if sold after a year or before maturity. The Interest Coverage Ratio or ICR determines the firm ability to comfortably settle the interest on its loans at any given time. Attention Investor, Prevent unauthorised transactions in your account. Receive information of your transactions directly from Stock Exchange / Depositories on your mobile/email at the end of the day. Check out our NCD Reckoner to identify the right NCD investment opportunity for you.

Key Features of NCDs

- Debentures and bonds are two borrowing routes that can help corporations raise funds from the public.

- However, the interest rate offered on unsecured NCDs is higher than that of secured NCDs.

- Convertible debentures are those debentures which give an option to the holder to get it converted either in a share of the issuing company after a specified period of time.

- Keep track if the company is regularly being able to apportion provisions for its non-performing assets.

- Look into their financial statements regularly, especially when the stock market is volatile or if there is news regarding the issuer.

- Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND.

Unsecured NCDs are not backed by any asset or collateral by the company. To compensate for this drawback, the interest rate offered by the company for such debentures is higher than that offered on secured NCDs. If the company defaults in its payments towards unsecured NCDs, the investors do not have any choice but to wait for such payments. It is, therefore, essential to invest in NCDs issued by high credit-rated companies to safeguard investor interest.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone. Some background check on the asset quality of the company can go a long way for NCD investors.

Let us look at the points of differentiation between convertible and non-convertible debentures. After it gets listed on the stock exchange, one can invest in NCDs through registered brokers or any other medium through which the stock exchange can be accessed. Big companies issue them to raise funds without giving any option of conversion to equity.

Investors can invest for a tenure that meets their financial objective and risk appetite. non convertible debentures meaning NCDs are issued by the companies to raise funds for any financial purpose. This purpose has to be specific and not ambiguous to ensure that the investor funds are used for correct reasons that attribute to the growth of the company.

Non-Convertible Debentures (NCDs) are debt instruments issued by companies to raise long-term capital. This means when you invest in an NCD, you are lending money to the company issuing it. In return, the company promises to pay you a fixed interest rate (also known as the coupon rate) and repay the principal amount on a specified maturity date. It is issued by a company to raise money and can be sold to investors in the form of bonds. In most cases, these types of NCDs are issued with a set maturity date, although this may vary depending on the issuer. The holder of an NCD receives interest payments over time until it reaches maturity when all principal becomes due.